HRM/Education

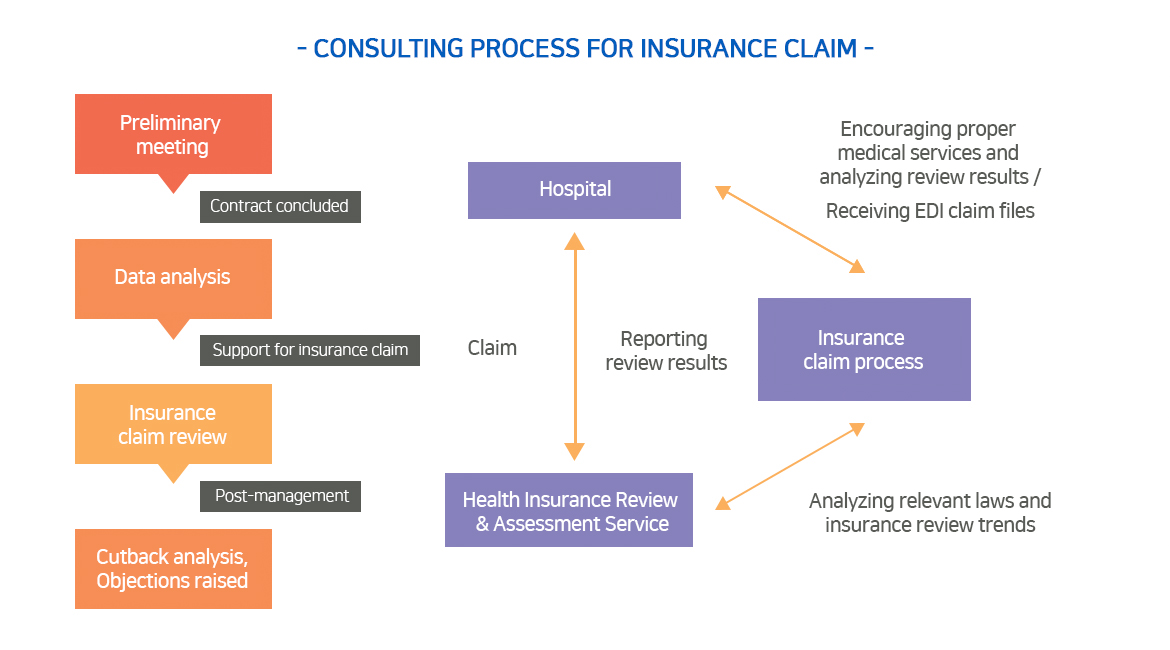

Consulting for Insurance Claim

A majority of the sales of plastic surgery clinics and dental clinics result from non-covered items.

However, a majority of the sales of most clinics and hospitals is health insurance benefits.

Therefore, it is very important to check if the correct amount of health insurance benefits is being claimed.

Unfortunately, many clinics have difficulty claiming the correct amount of health insurance benefits in accordance with laws and regulations due to a lack of skilled manpower and a heavy workload on what staff they do have. Some clinics claim the wrongamount of health insurance benefits in error due to high rates of cutbacks and pay a large sum of additional collection charges which worsen their management conditions.

Therefore, it cannot be emphasized enough that claiming the correct amount of health insurance benefits is very important in operating the hospital.

However, a majority of the sales of most clinics and hospitals is health insurance benefits.

Therefore, it is very important to check if the correct amount of health insurance benefits is being claimed.

Unfortunately, many clinics have difficulty claiming the correct amount of health insurance benefits in accordance with laws and regulations due to a lack of skilled manpower and a heavy workload on what staff they do have. Some clinics claim the wrongamount of health insurance benefits in error due to high rates of cutbacks and pay a large sum of additional collection charges which worsen their management conditions.

Therefore, it cannot be emphasized enough that claiming the correct amount of health insurance benefits is very important in operating the hospital.

Case

If the rate of cutbacks is 2% (example)

Assuming that XX Hospital has monthly average sales of 500 million won, the monthly average health insurance benefits claimed of 300 million won, the monthly average deductibles of 200 million won and the rate of cutbacks is 2%, it loses as much as 6 million won per month. The sum of its losses amounts to 72 million won per year. Considering that the legal prescription of health insurance benefits claimed is three years, it loses 216 million won over 36 months.

Assuming that XX Hospital has monthly average sales of 500 million won, the monthly average health insurance benefits claimed of 300 million won, the monthly average deductibles of 200 million won and the rate of cutbacks is 2%, it loses as much as 6 million won per month. The sum of its losses amounts to 72 million won per year. Considering that the legal prescription of health insurance benefits claimed is three years, it loses 216 million won over 36 months.

- Hospitals that need consulting for insurance claim -

· Hospitals that need to reduce the rates of cutbacks

· Hospitals having difficulty raising objections to the National Health Insurance Service

· Hospitals whose claimed health insurance benefits claimed keeps being cut back

· Hospitals having difficulty analyzing statistical data of cutbacks and health insurance review results

· Hospitals whose staff members suffer from heavy workloads due to insurance claims

· Hospitals having difficulty raising objections to the National Health Insurance Service

· Hospitals whose claimed health insurance benefits claimed keeps being cut back

· Hospitals having difficulty analyzing statistical data of cutbacks and health insurance review results

· Hospitals whose staff members suffer from heavy workloads due to insurance claims

- Benefits of consulting for insurance claims -

· Managing missed health insurance benefits by analyzing errors and mistakes on insurance documents and claims

· Managing the sales and preventing losses through a cutback analysis

· Understanding the standards for insurance review and suggesting a post-management plan through education

· Reducing objections and cutbacks through a cutback analysis

· Increasing profits by reducing cutbacks

· Managing the sales and preventing losses through a cutback analysis

· Understanding the standards for insurance review and suggesting a post-management plan through education

· Reducing objections and cutbacks through a cutback analysis

· Increasing profits by reducing cutbacks

Consulting for insurance claim which is directly related to hospital sales is not just a recommended service

but a necessary element for opening a hospital and improving the hospital business conditions.

but a necessary element for opening a hospital and improving the hospital business conditions.